Our Mission

All client validation processes—document checks, account creation, and risk assessments—were performed manually. Processing a single client could take up to a week and required up to 12 hours of a manager’s time. This limited growth and led to errors.

Who we are

A fintech company from the EU operating under regulatory supervision, providing payment solutions for both B2C and B2B clients.

What was automated?

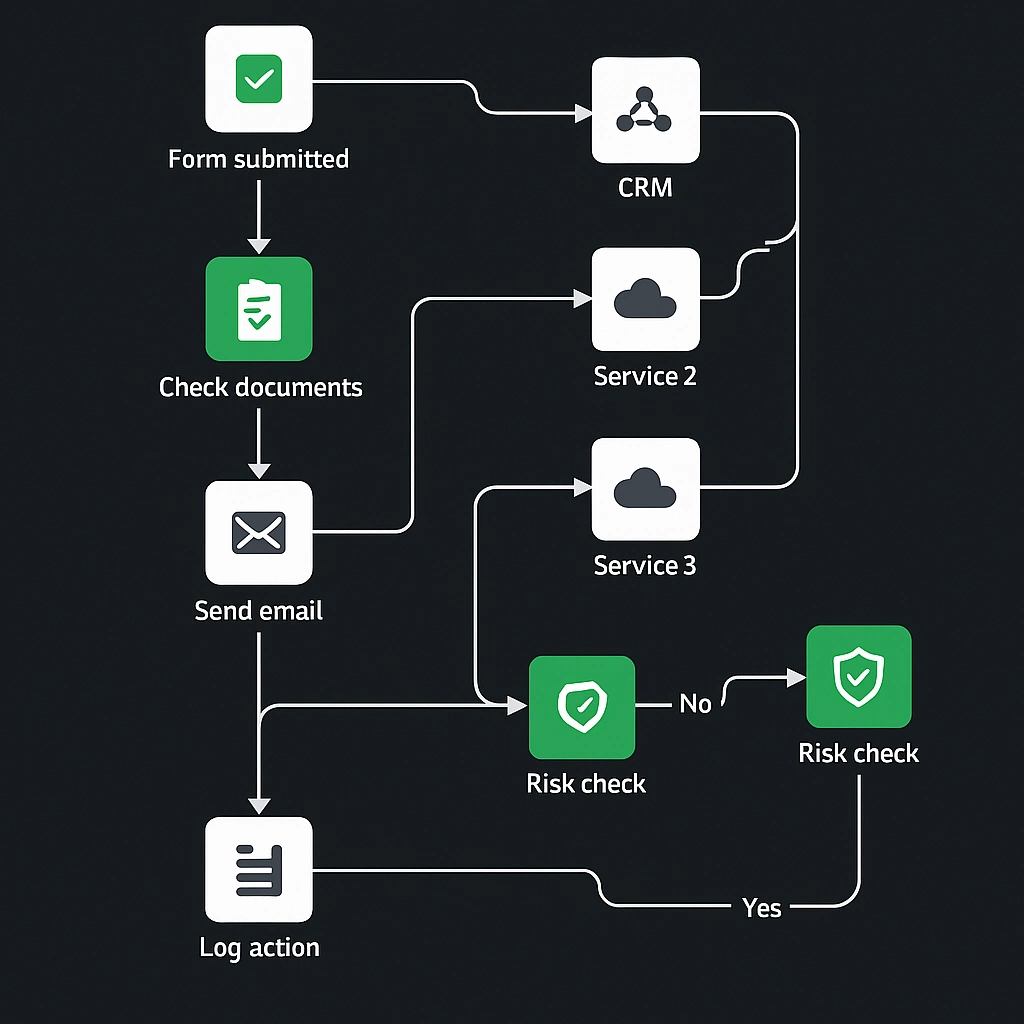

Collection and processing of documents from three channels: web forms, email, and third-party services

AI-powered data extraction from messages and automatic requests for additional information

Document verification for compliance with regulatory requirements

Automatic profile creation in Bitrix24

Risk assessment based on a risk matrix and country of residence

Full logging of all actions in accordance with financial security policies

Result

3×

faster

client processing: from 7 days to less than 1 day

Up to

90%

reduction in manual work:

from 7–12 hours to just 1 hour per client

0

error

caused by human factors

Throughput increased by

200%

without hiring additional staff

The team is fully focused on exceptional cases instead of routine tasks

Ready to boost your productivity?

Let us review your process and show how AI can simplify, speed up, and scale your operations – without hiring more people